Travel insurance it is one of those things that you often don't think about before leaving, and when you think about it .. you always hope to never have to use it! It is normal to be focused on the positive aspects of the departure, but unfortunately the unexpected can happen; the trick is to make sure they don't ruin our trip (and wallet!).

So .. why not leave calmly? Travel insurance (also called medical-baggage insurance) is specifically designed to cover some events that could cause us many problems while we are on vacation, namely mainly:

- medical and health emergencies

- trip cancellation or interruption

- flight delay or in the delivery of baggage

- damage or theft of baggage and documents

Travel insurance: when to do it

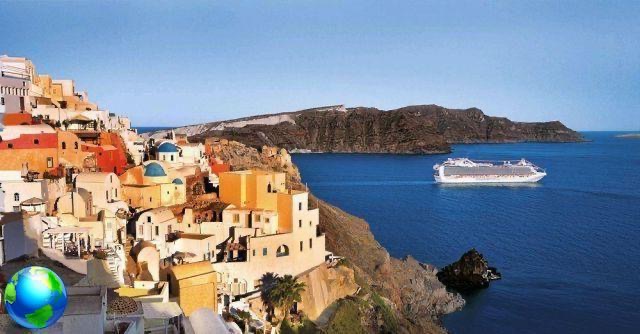

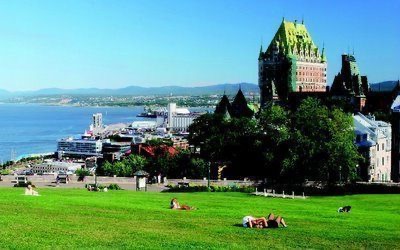

From my humble point of view, travel insurance should always be done, whether you travel, Europe or the rest of the world, but it is especially essential when traveling outside the European Community. In fact, the health card gives Spanish citizens traveling to the EU the same conditions that a citizen of that same country would receive. However, leaving the EU, even for a small injury, we could find ourselves paying 3 zero figures. The classic case is the United States or Canada where, without a health insurance that has adequate ceilings, you can't even go to the emergency room! In other countries, such as Cuba or Russia, the stipulation of health insurance is mandatory for obtaining a visa. In fact, few people know that, outside our health system, the price for example of a trivial appendectomy surgery can cost 30-50.000 euros, so ... why risk it? I don't feel like it.

Single or annual insurance? How much?

This choice of course it depends on the average number of trips you make in 1 year. If you make a maximum of 3 or 4, in principle, you should take out a single policy for each trip. If you do more (like myself), it is much cheaper (and useful) to opt for annual insurance (as long as each single trip does not exceed 30 days). I, for example, have entered into a 'Premium multi-trip annual insurance. It is the top of the range and costs 204 euros for 12 months.

Travel medical insurance: what you need to watch out for

To choose the best travel insurance there are a few things you need to be careful about. The 3 most important are:

Deductible

This term refers to that part of the damage that remains at your expense. It is predetermined by the insurance company, and can be a fixed amount or as a percentage of the sum insured. The lower the better! it applies to medical expenses and luggage (in which it is 50 euros, trust me it's very low!). In the temporary policy (i.e. the one that is made for a single trip) you can choose whether to keep the deductible or not.

Ceilings

These must be as high as possible! For health care costs, for example, we are not talking about 10-50.000 euros, but 500.000, 1 or more million euros. It might seem absurd to you but trust me! In the unfortunate event that you have a serious problem and you need a certain type of surgery and / or a prolonged hospitalization the figures would rise dramatically and it is good to be covered. My policy, again to give you a practical example, has a ceiling of 5 million euros.

After-sales assistance

It has to be simple and in Spanish. The emergency call center must be easy to contact and claim submission must be simple. I am very happy with many insurance companies also for this reason has developed a dedicated app that allows you to manage everything from your mobile. You can make the call free and instantly, simply by using your Internet connection, as if it were a call on WhatsApp. Just one click is enough to be in contact with the operations center which then indicates the nearest medical center or which assists you in any other type of insurance-related problem. The app also allows you to easily manage the sending of the necessary documentation (photos, vouchers ...) in case of theft, damage and delays in the delivery of luggage .. and for me this is priceless!

What is not included in the travel insurance?

There are conditions that lead to exclusion or non-coverage by insurance companies. In particular, the insurance companies do not cover accidents and claims deriving from:

- carrying out dangerous activities

- carrying out some sporting activities considered dangerous (e.g. free clibming, air sports, martial arts, etc.) and all sporting activities carried out in a professional capacity (some companies provide ad hoc policies for these)

- willful misconduct, gross negligence, negligence of the Insured

war, including civil war, strikes, revolutions, riots or popular movements, looting and acts of

terrorism - earthquakes, floods and other natural disasters (volcanic eruptions ..)

previous or chronic diseases - use of drugs and / or psychotropic drugs

- trips to countries at war or considered at risk, namely: Afghanistan, Burkina Faso, Burundi, West Bank, North Korea, Ivory Coast, Ethiopia, Haiti, Iraq, Kosovo, Lebanon, Libya, Liberia, Nepal, Papua New Guinea, Chechen Republic, Central African Republic, Republic of Congo, Democratic Republic of Congo, Rwanda, Western Sahara, Sierra Leone, Syria, Somalia, Gaza Strip, Sudan, Uganda and Yemen.

Which one did I choose:

Traveling for many years of insurance I have made many, with many insurance companies. Fortunately, nothing serious has ever happened to me (and we hope it never happens to me..tiè tiè tiè!) But in the last trips I'm getting along well with many insurance companies so I would recommend it (also for the reasons I mentioned above). A site that compares the policies of different companies and proposes the most convenient policy for that particular trip. The purchase process is online and you only have to enter the data relating to your trip (country, duration, etc.) to view the best offers and select the one that's right for you. In any case, I hope this article will help you regardless of the insurance you decide to take later.